Morality is an interesting concept, particularly when it comes to investing.

Many investors see buying stock in a company as a chance to root for the success of their favorite company, and in many ways…they are. The act of purchasing stock in a company marginally raises a company’s share price, as a company’s share price rises their cost of equity drops. The lower a firm’s COE, the easier it is for that firm to raise money and allocate that money towards accretive projects. After all, the ability for firms to easily raise capital is one of the few structural benefits from being a publicly listed company in the first place.

Investor’s desire for a “feel good” stocks has spawned a proliferation of various socially conscious stock ETFs.

Today I will write-up a slightly controversial stock, goeasy Ltd. which trades on the TSX under the symbol GSY and can currently be bought for $28.75. I was lucky enough to get in cheaper at $26.09 in late January but as you will soon see, the stock has MUCH higher to run.

Who are they?

There are two major components to goeasy’s business, easyhome and easyfinacial.

Here is a quick breakdown of the two from the company’s investors presentation.

Simple enough right? One half of the business leases big-ticket home appliances/furniture, the other half provides small unsecured loans to customers. This is where things begin to get a little dicey. Goeasy is different from other financial companies because their customer base is the lowest credit quality, most desperate borrowers. Goeasy markets itself as a better alternative to PayDay Loan companies.

On a typical loan, goeasy charges a shade under 60% interest so as to not run a foul of Canada’s Usery laws. As bad as this rate sounds, it PALES in comparison to Pay Day Loan companies which are allowed to charge $18 for every 100 borrowed over a two-week period in Ontario! (Where most of goeasy’s business is done)

Valuation

Goeasy is the perfect blend of both growth and value.

The stock currently trades at a cheap P/Adjusted Earnings of 12, has 12.6% Y/Y revenue growth, and an astounding 41.2% Y/Y adjusted earnings growth this past quarter.

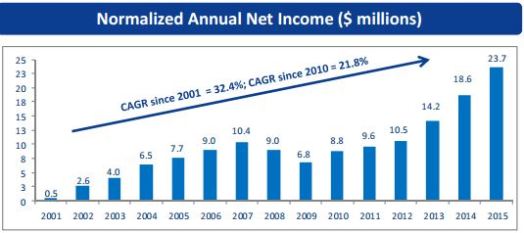

These numbers are not a one-off, but rather a continuation of the company’s stellar performance.

It’s tough to compare goeasy to their competition, goeasy has no publicly listed Canadian competetors, one must look to their neighbours in the US for an idea of appropriate valuations.

| Stock | PE | Consensus Forecasted Earnings Growth(%) | PEG Ratio |

| EZ Corp | 41.7 | 30.00 | 1.39 |

| Regional Management Corp | 10.7 | 9.8 | 1.097436 |

| One Main Holdings | 13 | 13 | 1 |

| World Acceptance Corp | 5.5 | -11.5 | N/A |

| First Cash Financial Services | 18.4 | 9.2 | 2 |

| Group Average | 17.9 | 10.1 | 1.371859 |

| Goeasy | 12 | 19.4 | 0.618557 |

As shown above, goeasy trades cheaper than its peers on a current earnings basis and is expected to out perform its peers on a growth basis. For goeasy to move inline with the industry’s PEG ratio, goeasy would need to appreciate it 121% from current levels.

Catalyst: Q4 Earnings?

Goeasy reports Q4 earnings on February 15th. Management hinted on the previous quarter’s conference call that they will announce a new strategy to super charge their already stellar growth.

A Question of Morals

Some may find goeasy to be an unethical company. Charging outrageous rates of interest to those who are most in need. In 2015 CBC went undercover to produce an exposé and show consumers just how much these quick loans were costing them.

While 60% annual rates of interest may seem to high, almost all of goeasy’s consumers have impaired credit scores and would be turned away from banks if they tried to apply for cheaper credit. If goeasy did not exist, these customer’s would be forced to use PayDay Loans or approach Loan Sharks, both of whom would charge multiples of what goeasy charges.

In addition, goeasy is forced to charge a high rate of interest to compensate for the high rates of loan delinquencies that come with making sub prime loans. Goeasy has to write down approximately 15% of their loan book each year due to bad debt charges.

For many consumers, goeasy’s loans help solve a short-term emergency funding gap and help alleviate short term financial woes. Goeasy’s internal surveys help demonstrate this:

Bottom Line

Given goeasy’s terrific growth profile and lack of competition in the Canadian sub-prime lending space I would conservatively be willing to pay up to 20X current earnings which imply a target price of $47.5 or 65% upside.

not really a fan of this one

bought more cascades and added vip on backdrop under 4. bought clr at 10,20 right after the huge buy on friday the 3thd. bought also some HLF (actually only 1/5 of a position given your warning) , “sadly” i see it go today.

3 out of 6 picks (and CLR is thx to the HLF pick) impressive. keep them coming, but please outside of the financial sector. just joking. i work for a bank, so i know what not to touch. all banks are toast as an investment, or trump has to change the rules (i’m a bit biased)

so, as usual, very good write up, just not my cup of tea

LikeLike

Thanks,

Not overly optimistic on the financial sector either but I go where ever the value is. Tough to find a lower PEG ratio on the TSX.

Got more picks I’ll do about 1/month or so

LikeLike

Pingback: Weekly Linkfest #25 - Financial Uproar

I don’t know if you and I are brothers but I also own a healthy position in ALA for the long run. Offers a nice safety dividend in what is a combination of utility and Natural gas handler. This combination is easy for me to hold in these strange investing times. I don’t trust those U.S. banks much with all their derivatives and black hole balance sheets and this is a stock that I think I can trust going forward. Also like the fact that they now own a deep water port of coast of B.C. with rail line support. they have some modest growth and the new acquisition offers some nice diversity of market with nice hedge on U.S. dollar exposure.

LikeLiked by 1 person

Haha that’s funny, Ironically that’s probably the stock Ill write up this month, maybe it’s due to the nosebleed valuations most stocks have these days but it’s remarkable how much commonallity I see in every (Canadian) Value investor’s picks.

LikeLike

Value investing generally keeps you out of trouble and usualy offers good gains if your’re patient. I tried being part momentum trader but It always seems to backfire. Most recent buys: bought PPY this morning and BUS 2 weeks ago.

LikeLike

I also forgot to mention that I owned Go Easy about 2 months ago and sold after a very quick 25% gain.

LikeLike